Disclaimer: The views expressed below are solely my own and do not represent the views of my employer. These perspectives are subject to change and likely will change as more data becomes available.

Musings and Predictions for 2024

While I’ve historically shied away from publishing my views publicly, I decided this was the right time to buck the trend and write down my predictions for what 2024 has in store. The main reasons I published this are to force myself to take a view on megatrends and to learn from anyone that reads this and has a thoughtful perspective to share on any of these trends. Given how uncertain the world is right now - macroeconomy, AI platform shift, geopolitical tensions, etc. - I expect to be wrong on several of these predictions - if things were certain they wouldn’t be fun (see Death/Taxes).

Happy Holidays,

Arye

SaaS and Startups

In the decade leading up to 2022 software did eat the world, as the market cap of public SaaS companies skyrocketed from ~$40B to over $2.2 Trillion, but over the last two years the world has experienced indigestion. The downstream impacts of the SaaSacre are still being felt over two years later, as growth is slowing and tech companies are adapting to a new normal. SaaS investors, employees and customers are wondering if we are finally out of the woods, which brings me to my first set of predictions:

Theme: Bifurcation of valuations between defensible and fragile businesses, especially across the SaaS universe.

Prediction: The standard deviation (i.e. dispersion of SaaS multiples) across public SaaS multiples will continue to increase over the next twelve months as investors double down on high quality and retreat from lower quality businesses.

During ZIRP, as a result of low interest rates making capital more accessible and remote work forcing companies to invest in digital transformation, many SaaS companies experienced remarkable growth as IT budgets ballooned and sales cycles compressed. That’s changed dramatically, as companies have battened down the hatches, scrutinizing spend, elongating sales cycles and executing layoffs. How companies will emerge is still to be seen and will largely depend on the company. While net dollar retention, gross retention and sales paybacks (key SaaS metrics) were largely inflated during ZIRP, where these metrics will shake out is TBD. Some companies will converge to a new normal lower than 2021 that is still reasonable, whereas other companies won’t find a floor, experiencing retention and sales efficiency metrics structurally different from what they saw during COVID.

In 2024 the software business model will face heightened scrutiny, as investors test assumptions around growth durability and free cash flow generation for SaaS companies. While investors largely assumed over the last 10 years that software businesses at scale would have attractive retention rates and free cash flow generation (justifying premium multiples), artificial intelligence adoption will lower the barriers to entry, testing defensibility of software moats.

This will lead to an increase in standard deviation of multiples across the public SaaS universe. The best SaaS companies will separate further from the pack and will be rewarded with premium multiples while companies with questionable durability will be punished with lower multiples. This trend has already started to take shape throughout 2023, as the top ten revenue multiple public SaaS companies saw 50% multiple expansion (16.1 vs. 10.7x) over the last twelve months, whereas the overall basket of public SaaS companies only saw 25% multiple expansion (6.5x vs. 5.2x).

Unlike prior periods, where high growth or free cash flow generation could warrant premium multiples, I expect even profitable businesses with good growth prospects to display below-median multiples if investors aren’t comfortable with their long-term durability (this has already happened to some public SaaS names trading near all-time low multiples despite solid growth and margins). An example of the type of companies favored by investors will be ones with structural stickiness and vertically-oriented embedded workflow solutions with source of truth data, ideally that can be leveraged to build AI use cases (e.g. Procore, Appfolio, Samsara). Lightweight horizontal solutions that lack clear defensibility will be punished as competition increases and investors assess the impact of the marginal cost of building software decreasing. In a world where AI makes writing code as easy as writing natural language, the barriers to entry in software will decrease, leading to increased investor-scrutiny of software business models.

Theme: Startups shutdowns and layoffs - another shoe to drop before normalization.

Prediction: Layoffs and down-rounds accelerate for private SaaS startups, but overall funding (especially in growth/PE) increases dramatically over 2022/2023 volumes.

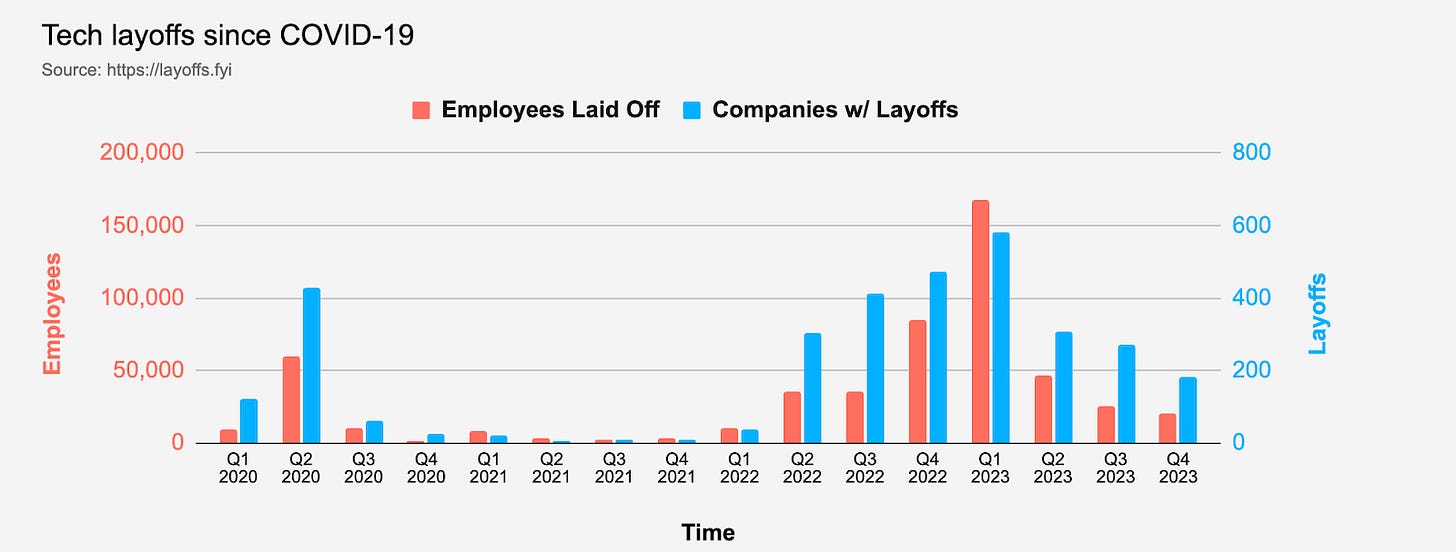

Another bifurcation that has developed is the separation of the SaaS landscape from the broader economy - while the S&P 500 and Dow are near all-time highs, the WCLD cloud index is still ~50% off its Q4’21 all time highs - in 2024 I expect another bifurcation to take place, as the startup SaaS landscape becomes further removed from the public SaaS universe. As others have noted, many companies that raised money in 2021 haven’t yet faced austerity and will run into cash flow issues in 2024. Relatedly, while some portion of companies that raised during ZIRP will eventually grow into their last round valuations, many likely won’t, but will still persist as businesses (and may raise down-rounds). Another category of startups, however, lack durable business models and will eventually face severe headwinds in 2024. These companies, many of which have delayed fundraising as they’ve tried to pivot, will unfortunately be unable to raise more funding and will run out of capital, leading to more severe layoffs (50% headcount cuts vs. 5-15% cuts mostly seen in 2023) and wind-downs. Although tech layoffs have declined for the last four quarters and some news outlets have declared victory over layoffs, I expect layoffs to accelerate in 2024, testing the peaks seen in Q1’23, as startups face runway issues and/or wind down.

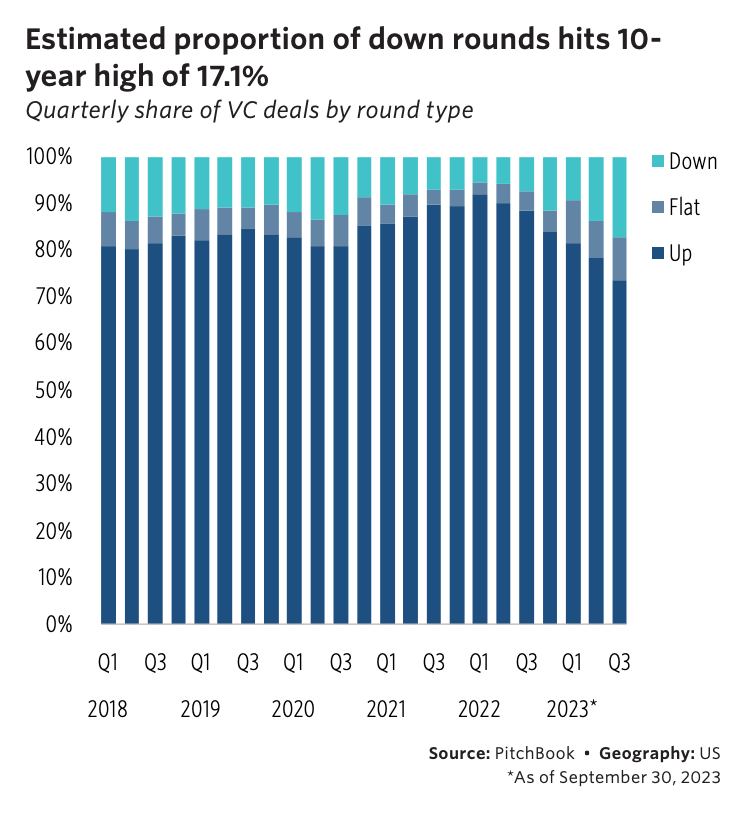

Many startups facing runway issues that are forced to raise capital will raise down rounds, which I expect to increase to over 25% of total fundraises in 2024, even above the 10-year high of 17% seen in Q3’23. This will have downstream effects on the VC ecosystem, as some companies that were considered “fund-returners” for their early backers, will be forced to raise rounds at dramatically lower valuations. Other companies that can’t access clean equity, will be forced to raise “pay-to-play” rounds, where companies reset their cap tables and dilute insiders who don’t participate down to as little as zero. Down-rounds and equity recapitalizations will negatively impact VC paper returns, making the fundraising environment even more difficult for managers, especially emerging managers who haven’t realized any significant gains. However, the pressure on startups to raise capital and increased down rounds will lead to increased growth investing activity - I expect growth investing in 2024 to increase by over 30% from 2023 dollar values as many more growth companies come to market.

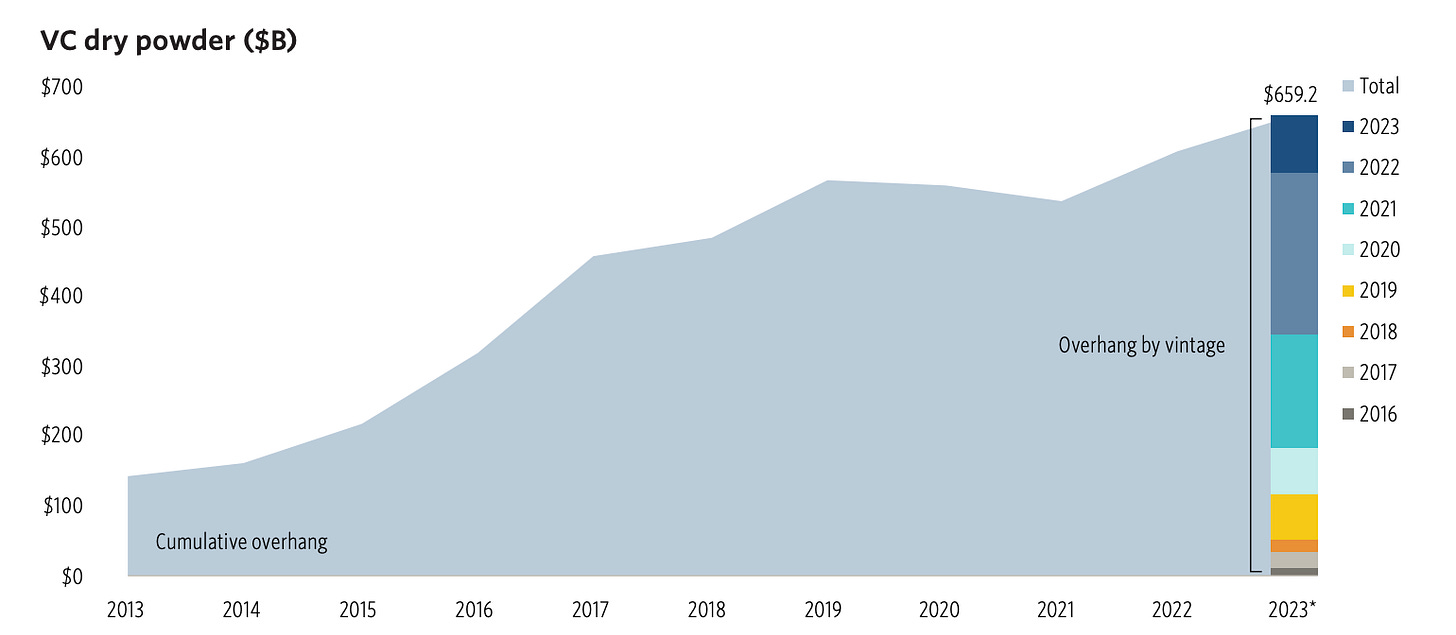

Although layoffs and down-rounds may seem like bleak forecasts, I actually believe there are reasons to be optimistic for the startup ecosystem more broadly. Companies building in this era will need to do more with less, making them more efficient, and high-quality talent will become more available as big tech companies slow down hiring. The proliferation of B2B AI solutions, which I expect to become more prevalent in 2024, will also enable productivity gains, as startups start leaning on AI to gain cross-functional leverage, across customer success, sales, marketing, R&D, FP&A, etc. Furthermore, given VC dry powder (>$650B) is near all-time highs, there is an enormous amount of existing capital available to fund startups building in this era.

Finally, although there have been many headlines detailing layoffs across the SaaS ecosystem, larger public and private SaaS companies generally grew headcount in 2023. The table below shows LinkedIn data across a sample of 36 of the larger public and private SaaS companies globally. Although hiring has softened and many of these companies executed layoffs in 2023, headcount growth across the SaaS universe (among larger companies) has actually been positive throughout 2023. This implies that while hiring growth has slowed, companies are still growing, and becoming more efficient as revenue growth likely outpaces hiring growth.

Theme: DPI takes center stage but the exit environment proves difficult.

Prediction: Private Equity M&A increases significantly over 2023 as firms chase DPI.

Historically, there are three ways tech startups typically exit or create liquidity for investors and employees: IPOs, strategic exits and financial sponsor-backed exits (shoutout to Qualtrics, which did all three, and Cvent, which went public twice and was bought twice). The largest and most successful venture-backed companies generally go public and in some cases sell to other large tech companies, whereas PE buyers typically pay the lowest price given they don’t have liquidity like public markets investors and can’t underwrite revenue and cost synergies like strategic acquirers.

Unfortunately for many VC-backed startups, we are currently in an environment where the ideal two pathways to exiting are proving difficult. There have only been three major VC-backed tech IPOs since 2021 (ARM, Klaviyo and Instacart) and all three traded below their issue prices after going public (with Klaviyo and Instacart still trading below their IPO prices), representative of a market environment still digesting the enormous tech IPO volume that took place in 2021. Furthermore, big tech companies have been essentially handcuffed from doing large M&A, as regulators (FTC/DOJ/UK’s CMA) have taken an aggressive stance preventing big tech companies from making large acquisitions. One prime example of this is the acquisition of Figma by Adobe, which would have been one of the largest tech deals ever, but was called off this month after a grueling 15+ month regulatory approval process.

While many are optimistic about the IPO floodgates opening in 2024, I am not as hopeful. Especially in the first half of the year, I expect uncertainty persisting around inflation, interest rates and the broader macroeconomy to give investors pause, making IPOs challenging. Even once the tech IPO market does reopen, it won’t be anywhere near its ZIRP highs, causing a supply demand imbalance as 1,000+ unicorns make up a multi-year backlog. For the many companies that don’t see an IPO on the horizon and don’t have the scale or financial profile necessary to go public but still want liquidity, private equity will serve as a viable alternative. Late-stage investors aiming to realize gains and distribute capital and founders who want liquidity will take a more constructive posture towards PE, leading to PE activity in 2024 that is 20%+ higher than it was in 2023.

Finally, I predict an increase in down-rounds and increase in private equity buyouts of venture-backed businesses will outweigh the number of net new unicorns minted in 2024, leading to an overall decrease in the total number of unicorns from 2023 to 2024.

That said, while I expect more unicorn deaths than births, I also expect the unicorn birth rate to accelerate and for there to be more unicorn births in 2024 than there were in 2023, driven by an increase in the number of net new AI unicorns.

Artificial Intelligence

Theme: LLMs arms race intensifies as capital and talent consolidate further.

Prediction: The top LLMs (OpenAI, Anthropic, Mistral, maybe Gemini, 1-2 others) extend their lead, as non-market leading LLMs get caught in the middle then left behind.

Over the last year we’ve seen billions of dollars invested in Large-Language-Model providers. These businesses are investing enormous amounts of money into compute resources and researchers as they try to establish themselves as the model layer for B2B and consumer use cases. Over the next year, I expect there to be a separation between the haves and have-nots among LLM providers, with capital and talent consolidating to a few (5 or less) leading closed-source and open-source providers who will capture 80%+ U.S. LLM market share. Research labs that aren’t leading will find it more difficult to access the capital needed to stay in the LLM race and will pivot to specific areas of focus. This separation will take place because the next generation of leading LLM models will require 10x+ more capital than previous ones, making it difficult for smaller LLM labs to keep up. The only non-market leading LLM labs that maintain access to large amounts of capital will be ones that have geographic ties serving nationalistic interests (i.e. Japan, China, Germany, etc. may continue investing in LLMs that aren’t market leaders for nationalistic purposes). Finally, although the AI community was mainly focused on the GPU shortage in 2023, in 2024 the scarcity of talent will take center stage, as a small number of AI labs will employ the majority of AI research talent.

Theme: GPU resellers - bifurcation of quality as market matures and GPU crunch eases.

Prediction: H100 prices drop over next twelve months and GPU resellers that don’t have product differentiation or scale advantages face acute headwinds.

The GPU reseller market has emerged within the AI landscape and seen enormous growth over the last twelve months. This market has received billions of dollars of VC investment as startups have been willing to pay high prices for access to NVIDIA GPUs. The most in demand of these GPUs is currently the H100 chip, which is the most powerful chip for certain AI use cases, most notably training. Coreweave and Lambda Labs are two of the largest cloud provider startups reselling GPUs, and many additional startups have emerged that are offering software and services on top of accessible GPU clusters.

I expect there to be a bifurcation in this market as well, as the most scaled players with strategic importance to NVIDIA (e.g. Coreweave) dominate the pure-play reseller market and the rest of the market converges on 1-3 players that layer sticky software and services on top of their GPU clusters. This perspective is largely driven by my prediction that H100 spot prices will decline over the next 12 months, which I believe for several reasons. Firstly, NVIDIA increasing H100 supply and releasing its next-generation B100 chip will ease the supply/demand imbalance. Secondly, as AI products move further into production there will be a mix-shift from training workloads to inference workloads, which can be effectively serviced by NVIDIA’s less expensive A100 chips, AMD’s chips or Application-Specific Integrated Circuit (ASIC) chips focused on inference that are being developed. Third, because edge computing will be more prevalent for inference workloads and smaller, fine-tuned custom model workloads (which I expect to become more common in 2024), data centers without H100 capacity will service more compute. Equinix’s GM of Data Services recently highlighted this trend in a company presentation on 12/5/2023, saying they are seeing companies use centralized data centers for compute-intensive training workloads where having centralized secure environments is paramount, and relying on distributed data centers or even classic CPUs for inference workloads. This makes sense from a performance/latency perspective (closer to the user) and a cost perspective (cheaper compute). Finally, I’m excited to see more use cases for smaller models be truly handled at the edge (on our devices), which won’t require H100s.

If this hypothesis is correct, what does that mean for the GPU reseller market? Unlike the GPUs that they sell, not all GPU resellers are created equal, leading to a range of impacts across the companies in this market. The key areas of differentiation that will separate the winners from the losers in this market will be: 1) Relationships with suppliers like NVIDIA, hyperscalers, and the large data center companies - some companies will have the scale and network to negotiate better deals than others leading to a differentiated cost structure, 2) Customer contract terms, as some GPU resellers will negotiate better (longer) contract terms with their customers, locking in higher prices, 3) More efficient infrastructure, as certain companies will bring down their costs through more efficient routing, cheaper access to energy or more optimized data center layouts and 4) Sticky software and services offerings layered on top of their GPU clusters. The non-pure-play GPU resellers are unlikely to have a scale advantage and will therefore need to build software and tooling to retain customers and drive margin once GPU prices decline, eroding the core source of their margin today.

Finally, I expect there will be some GPU resellers who don’t differentiate in any of the areas mentioned above and will see their growth and margins degrade as this market develops. The resellers most at risk will be ones that are levered long GPU prices with long-duration supply commitments at elevated prices and short-duration demand contracts that face volatility.

Macro

Theme: Consensus continues to be wrong, expect the unexpected.

Prediction: The U.S. enters a recession in 2024.

The one consistent macro theme since January 2020 has been consensus being wrong. First consensus believed that COVID would be contained to China and have limited impact on the West. Once it became clear COVID was a global phenomenon consensus believed the world was ending and markets tanked. After that, people thought the way to beat COVID was to lock everyone in their homes, force them to wear masks and pull kids out of school. After COVID was more-or-less contained and the economy was booming, many believed the U.S. was facing hyperinflation. Then once the Fed started raising interest rates in 2022, consensus quickly shifted from worrying about inflation to being 100% certain the U.S. was headed into a recession in 2023, which never came. There were other twists and turns over the last 3 years where consensus was wrong that I left out, but broadly speaking that sums up the post-COVID era and brings us to today.

Before I make my prediction for what 2024 has in store, I think it’s worth reflecting on how prescient J. Powell and The Fed, have been over the last three years. They literally became a meme for predicting inflation was transitory, which it now looks like it was. Then, when The Fed raised rates in 2022 and consensus was predicting a recession with certainty, the Fed held the line on their prediction that a recession would be avoided, which proved correct through 2023. While I know popular opinion loves blaming the Fed, they’ve actually done a wonderful job over the last three years and have mostly been proven right every step of the way.

With that all said, I predict the U.S. will enter a recession in 2024. The impetus could be some combination of China economic turmoil / property crisis spilling over, oil shocks, U.S. consumer/credit tightening or, if history is any indication, some other unforeseen exogenous economic/geo-political catalyst. I agree with conventional wisdom that the only predictable thing about macro predictions is that they are wrong, so I’ll be brief here and just mention some macro themes and data points on my mind. On the consumer side, charge-off rates and delinquencies for Amex/Discover/Capital One have all increased over the last few quarters, but consumers are borrowing more and the total U.S. debt balance is at an all time high, even though rates have increased dramatically. Corporate debt could be another economic stressor, as short-term debt with original maturity within a year has tripled over the last quarter and according to the IMF over $2.5T U.S. bonds and loans mature in 2024.

Other factors that could lead to a slowdown include housing prices finally feeling the impact of higher interest rates as more supply comes to market, excess savings from COVID waning causing consumers to reduce spending, inflated credit scores increasing poor loan activity, and increased unemployment as more companies implement layoffs. Ultimately, it’s hard to see how a recession plays out without a sharp increase in unemployment, so whatever serves as the impetus will likely have spillover impacts on the jobs market. In the case that the U.S. does go into a recession, the bright side will be rates coming down, making credit more accessible, a more liquid job market boosting per unit productivity and inflation easing, improving purchasing power for consumers.

Finally, before I wrap up with some “honorable mention” predictions, I’d love to make this interactive and see where consensus among readers lies relative to my predictions above. To that end, I’ve created a survey form with an option to vote yes or no to each prediction. I will keep all the responses anonymous and will check them next year and whoever is most right will receive a prize from me next holiday season. Most of the views below are loosely held and are meant to spur discussion. I would love to hear where you agree or disagree (even better) with my perspectives. We live in exciting times and it will be fun to watch as so much changes over the coming months/years!

Honorable Mention:

AI regulation will become an even bigger topic in the mainstream media - I expect a question on AI regulation in one of the presidential debates

AI Agent consumer use cases finally gain traction

Restrictions on Big tech M&A persist through the next election cycle (<three $10B+ software buyouts to strategics (i.e. other tech companies)

Inflated rates lead to a debt crunch as commercial credit spreads widen

SF commercial real estate bifurcation - rents in Fidi will face a steep decline but other areas of the city (Dogpatch, Mission Bay, Hayes Valley, Jackson Square) will see significant rent increases

AI for services platforms proliferate - I expect there to be vertically-tailored AI-native solutions with meaningful adoption across several verticals (accounting, finance, law, data science, etc.) with several unicorns minted across this theme

Opensource/smaller models gain traction, especially as AI tooling improves and enterprises become more efficient at routing complex use cases to best-in-class models and simple or expensive use cases to OSS or smaller fine-tuned models

Amazon makes a big AI announcement, increasing its relevance in the AI landscape

Increased scrutiny on stock-based compensation for mature SaaS companies, especially as mature SaaS companies are increasingly valued on earnings multiples

China faces a severe recession / real estate crisis

Things I don’t expect to happen:

SNL gets funny again :(

TikTok usage declines or faces a federal ban

More people watch the Oscars

SPACs come back

Miami has a unicorn exit

Hey Arye, this was great! Really appreciate your insight and clarity of thought. Looking forward to your next post!